What is Bank Validator?

OK, this is probably not going to come as a shock, but the Bank Validator is for validating bank account numbers. Specifically New Zealand and Australian bank account numbers. It adds an immediate visual feedback to every page that contains a Bank Branch No. and Bank Account Number field. Namely:

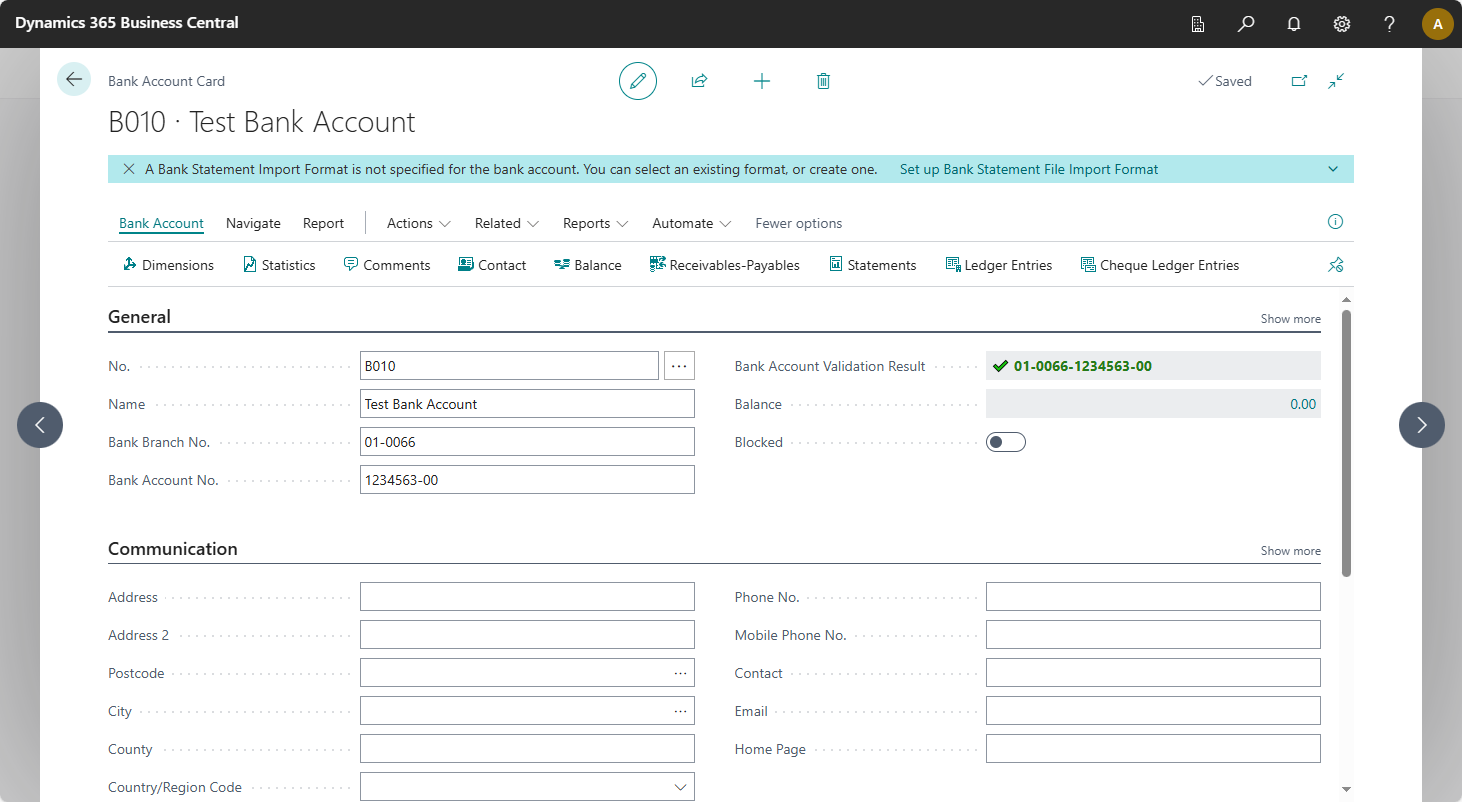

- Bank Account Card

- Vendor Bank Account Card

- Customer Bank Account Card

- Employee Card

In addition to the displays on the setup cards, the Payment Journal will show a warning if the bank account number used on the related account is not in a valid New Zealand or Australian bank account number format.

We don’t alter the data and we don’t stop you from using the bank account if it’s not valid, however, the Bank Account Validation Result field that has been added to each of the previously listed pages shows a big bright friendly green tick if the entered number is valid according to the validation rule that has been selected.

Here’s a bigger image of that field.

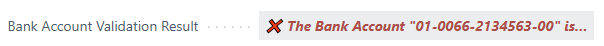

Imagine when you keyed in that bank account number you accidentally switched the first two characters of the base account number.

Here you can immediately see there’s a problem with the big red cross and an explanation of what’s wrong. The full explanation of this particular error is:

❌ The Bank Account “01-0066-2134563-00” is not valid for Bank ID “01” and Branch “0066”.

That’s just one of the many possible validation errors. It’s telling us that although “01” is a valid bank in New Zealand and “0066” is a valid branch for bank “01”, the account number “2134563” does not have the correct check digit at the end which is most likely caused by miskeying the number into the entry field. You can find a complete list of error messages and their meaning in the Errors Explained topic.

If your business uses Australian bank account numbers, you can set the Default Validation Rule on the Bank Validation Setup page to Australian Bank Validation which will ensure the BSB number entered is in a valid format and matches a list of known possible values.

If you want to learn more about exactly how the validation is working, take a look at the Bank Account Validation Rules, but in summary here’s what we do:

For the Kiwis

- Ensure the entered values in the Bank Branch No. and Bank Account Number fields, when combined together, match the required formatting of a New Zealand bank account number

- Compare the bank id to a list of bank codes provided by PaymentsNZ

- Ensure the branch number exists for the bank using the same PaymentsNZ list

- Use the correct modulo checksum calculation for the bank to ensure the final digit of the base account number is correct for the other entered digits

For the Aussies

- Ensure the entered values in the Bank Branch No. and Bank Account Number fields, when combined together, match the required formatting of an Australian bank account number

- Compare the first seven characters of the bank account number (the BSB Number) to a list of codes provided by Australian Payments Network

What is Validation?

Valid vs Verified

Whilst we can't guarantee the bank account number you have entered is correct, we can ensure it is valid (meaning it conforms to the validation rules). The realtime feedback during data entry can help to eliminate storing miskeyed data, which becomes more time consuming to resolve when the original source data is no longer at hand.Bank Validator Setup

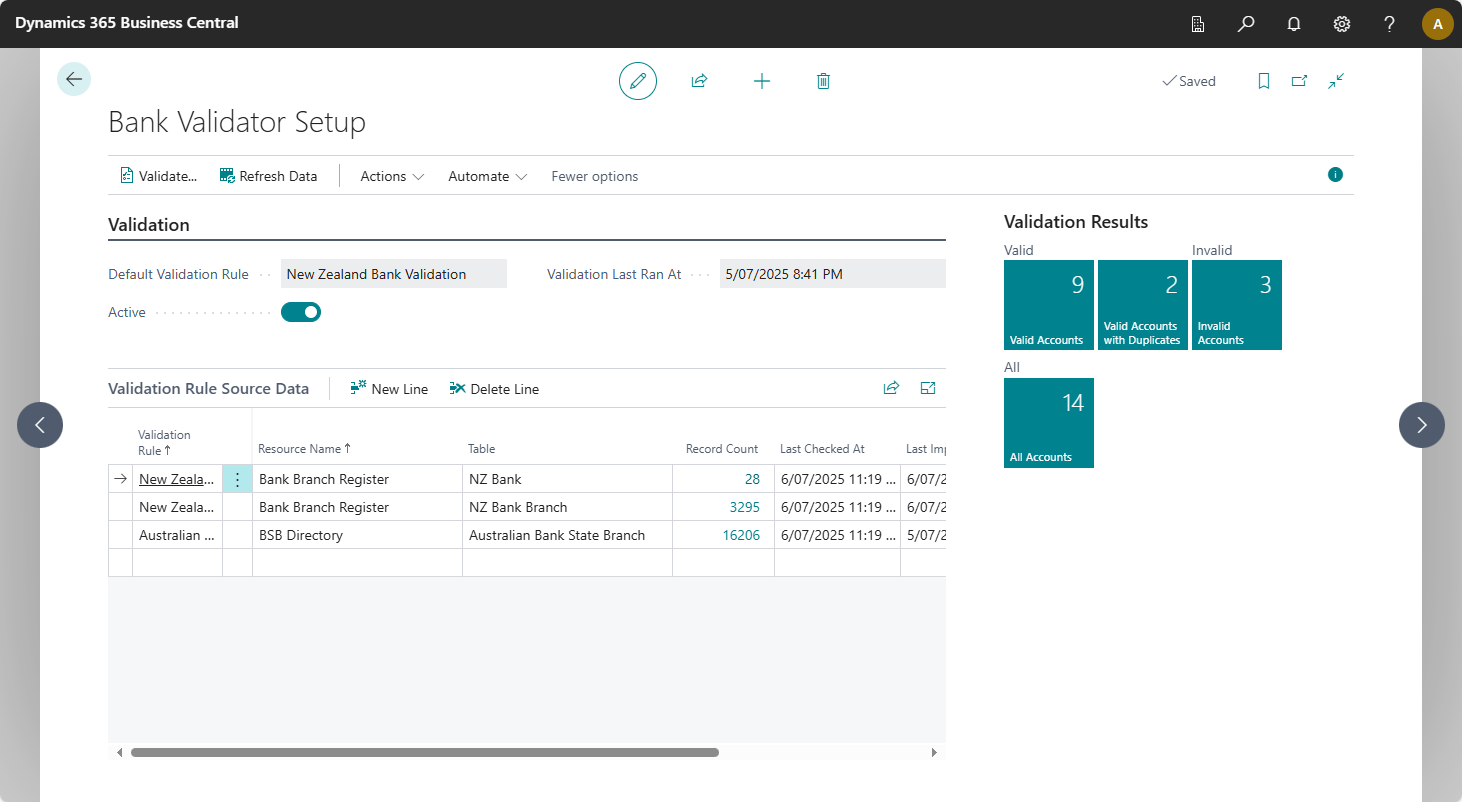

The Default Validation Rule field must be set before the app can be activated. It is possible to have a mixture of validated Australian and New Zealand bank accounts, but each new bank account will always be initially validated using the default validation rule.

In addition to the immediate visual feedback, we provide an ability to get an overview of which accounts are used in the system and categorise them as:

- Valid Accounts

- Valid Accounts with Duplicates

- Invalid Accounts

- All Accounts

You can view this summary from the FactBox pane on the Bank Validator Setup page.

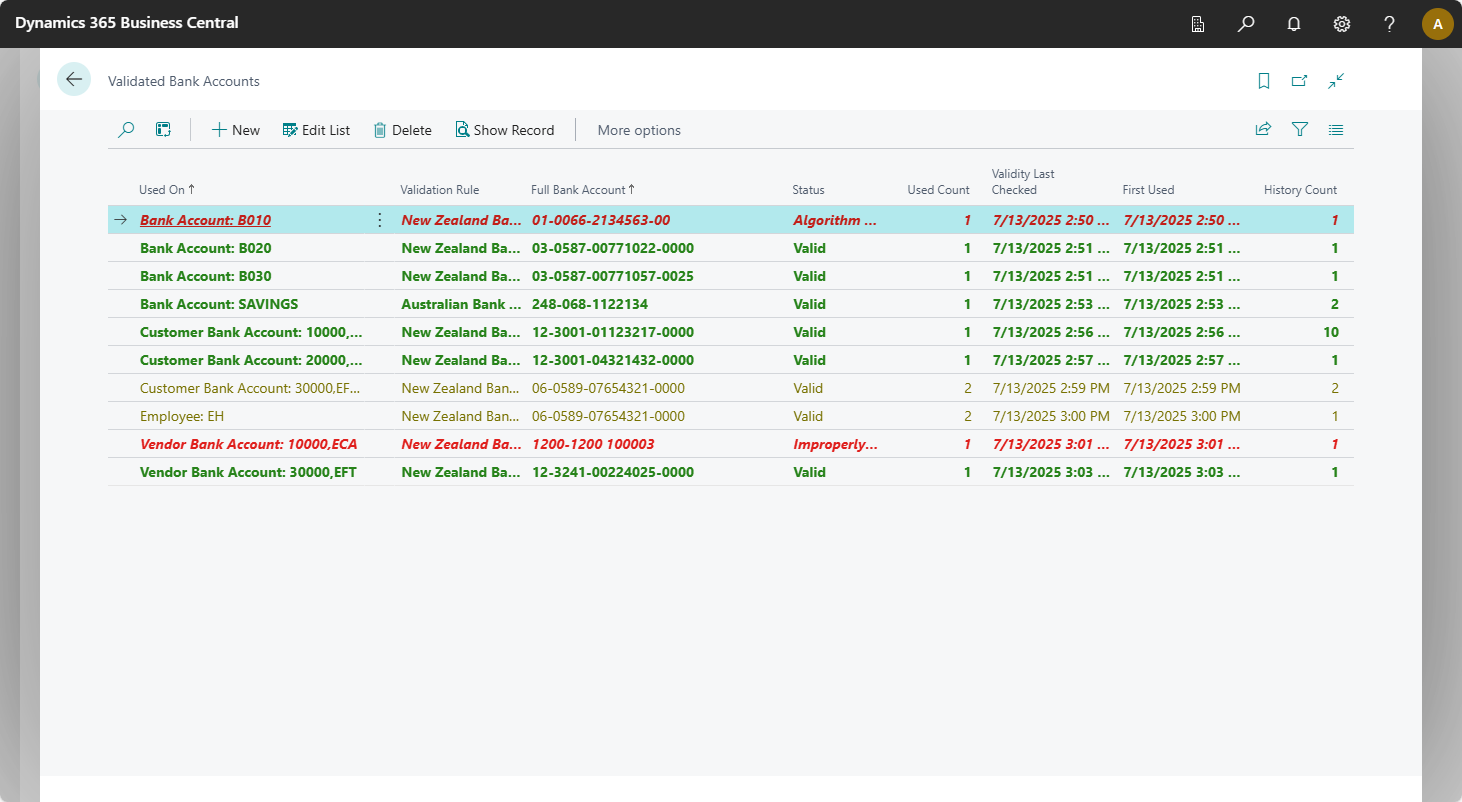

You can drill down on the tiles to show the details of the bank accounts which provides a quick and easy way to navigate to the card with the invalid bank account, allowing you to correct the mistake.

For more details see the Bank Validator Setup and Validated Bank Accounts sections in the context sensitive help topic.

For more details on installing and configuring the extension, see the Install Guide help topic.

How Much?

Unlimited Free Trial in Sandbox

This extension is fully featured and completely free to use in a sandbox environment, so you can install the extension and try it out without paying a cent. Use it for as long as you like in your sandbox environments.

Limited Free Trial in Production

It seems too good to be true, but if you decide to go ahead with our extension in your Production environment, you will get another free trial. You will need to purchase and assign licenses to your users, but you will not be charged for the first thirty days of use, and when your subscription does start to appear on your bill, you can cancel at any time. All licenses are managed through your Microsoft 365 Admin center and billed directly to you as part of your regular Microsoft Invoice (or can be bought using a credit card if you prefer).

Bank Validator is available through Microsoft’s AppSource and just in case you’re not sure how to get started and install the product, checkout our Install Guide.